A single pharmaceutical drug can be protected by more than 100 patents - but most people don’t realize over 90% of these aren’t the original patent. These Secondary patents are the key tools pharmaceutical companies use to keep competitors out of the market for years longer than expected. Understanding secondary patents is crucial because they directly impact drug prices and access to medicines worldwide.

What Are Secondary Patents?

Secondary patents protect aspects of a drug beyond its core chemical compound. Unlike primary patents, which cover the active ingredient itself, secondary patents cover things like how the drug is made, delivered, or used. For example, a primary patent for a cholesterol drug might protect the chemical formula. A secondary patent could cover a new tablet coating that makes it easier to swallow, or a specific way to treat a rare condition with the same drug.

The Hatch-Waxman Act of 1984 created the modern framework for these patents in the U.S. It balanced drug innovation with generic competition. But over time, companies learned to use secondary patents strategically. A 2012 PLOS ONE study found secondary patents add 4-5 years of patent life for drugs with chemical compound patents. For drugs without those primary protections, they can add up to 11 years. This has turned into a major part of Pharmaceutical Lifecycle Management.

Common Types of Secondary Patents

| Type | What It Covers | Example | Impact |

|---|---|---|---|

| Polymorphs | Different crystalline forms of the drug | GlaxoSmithKline’s Paxil (paroxetine Form G) | Delayed generic entry until 2005 despite primary patent expiring in 2001 |

| Formulation | Specific delivery methods (tablets, liquids, sustained-release) | AstraZeneca’s Nexium (esomeprazole) | Extended exclusivity by 8 years after switching from Prilosec |

| Method of Use | New medical applications for existing drugs | Thalidomide for leprosy (1998) and multiple myeloma (2006) | Blocked generic entry for specific indications |

| Combination | Drugs used together for better results | Humira (adalimumab) with methotrexate | Part of AbbVie’s 264-patent strategy |

| Manufacturing Process | New production methods | Roche’s Tamiflu production technique | Extended U.S. exclusivity until 2016 despite primary patent ending in 2009 |

These patents aren’t random. They’re carefully chosen to block generics. For instance, polymorphs (different crystal structures) make up about 18% of secondary patents. Formulation patents account for 22%, while method-of-use patents cover 15%. The Orange Book - a U.S. FDA list of approved drugs and patents - only includes certain types. Companies strategically choose which patents to list here to maximize legal barriers.

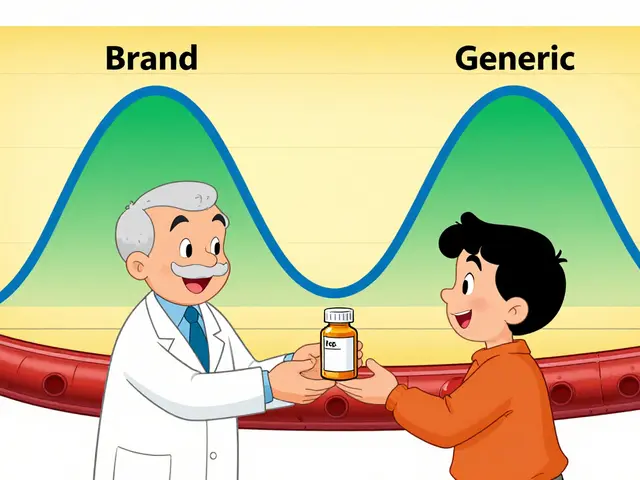

How They Extend Market Exclusivity

Pharmaceutical companies start planning secondary patents 5-7 years before the primary patent expires. They file formulation patents 3-4 years before expiration and method-of-use patents after FDA approval. This timing is critical. AstraZeneca’s Nexium switch happened just 1 year before Prilosec’s patent expired. This created a "product hop" - patients and doctors shifted to the new version, making generics less appealing.

According to a 2019 Health Affairs study, drugs with secondary patents face generic entry delays averaging 2.3 years longer than those without. Method-of-use patents are especially effective: 68% successfully block generics for specific indications. For high-revenue drugs, companies are 17% more likely to file secondary patents for every billion dollars in annual sales. This is why Humira - with 264 secondary patents - kept generics out until 2023 despite its primary patent expiring in 2016.

But it’s not foolproof. India’s Section 3(d) of the Patents Act blocks patents for new forms of known drugs without proven clinical benefits. This stopped Novartis from patenting Gleevec’s beta-crystalline form in 2013. Brazil also requires health ministry approval for pharmaceutical patents, creating another hurdle.

The Debate: Innovation vs. Access

The use of secondary patents is deeply controversial. Drug companies argue they drive innovation. PhRMA CEO Stephen Ubl says secondary patents lead to "improved safety profiles, better dosing regimens, and new treatment options." Dr. Tomas Philipson, former FDA chief economist, claims they contribute $14.7 billion annually to pharmaceutical R&D funding.

But critics call it "evergreening." Harvard Medical School’s Dr. Aaron Kesselheim found only 12% of secondary patents correspond to clinically meaningful improvements. Patient groups highlight cases like Humira, where 264 patents kept prices high. The American Cancer Society supports secondary patents when they reduce side effects - like new chemotherapy formulations that cut severe reactions by 37%.

Generic drug makers face massive hurdles. A 2022 Generic Pharmaceutical Association report says navigating patent thickets adds 3.2 years to market entry and $15-20 million in legal costs per product. Pharmacy benefit managers like Express Scripts report secondary patents increase their costs by 8.3% annually. For patients, this means higher out-of-pocket expenses and limited access to cheaper alternatives.

Current Trends and Future Outlook

Regulators are pushing back. The 2022 Inflation Reduction Act lets Medicare challenge certain secondary patents. The European Commission’s 2023 Pharmaceutical Strategy targets "patent thickets" as barriers to generics. The WHO identified secondary patents as the top legal reason for delayed generic access in 68 low- and middle-income countries.

Recent court decisions are also changing the game. The 2023 Federal Circuit ruling in Amgen v. Sanofi limited antibody patent scope, which could affect future secondary strategies. Industry analysts predict secondary patent filings will grow at 5.8% annually through 2028, but with stricter legal standards. Dr. Roger Longman of Windhover Information warns, "By 2027, successful pharmaceutical companies will need to demonstrate meaningful clinical improvements to maintain public and regulatory support."

For now, the tension between innovation incentives and drug access continues. Secondary patents remain a powerful tool - but one under increasing scrutiny as governments and advocates push for fairer systems.

What’s the difference between primary and secondary patents?

Primary patents protect the drug’s core chemical compound and last 20 years from filing. Secondary patents cover aspects like formulation, method of use, or manufacturing processes. They’re filed after the primary patent and can extend exclusivity by years. For example, a primary patent for a blood pressure drug covers the active ingredient, while a secondary patent might protect a new tablet coating that reduces side effects.

How do secondary patents delay generic drugs?

Generic manufacturers must prove their product doesn’t infringe on any listed patents before entering the market. With secondary patents, companies often file dozens of patents covering minor changes. For instance, Humira’s 264 patents created legal roadblocks that kept generics out until 2023. Generic companies must challenge each patent individually, which takes years and costs millions.

Are secondary patents legal everywhere?

No. India’s Section 3(d) bans patents for new forms of known drugs without proven clinical benefits. This blocked Novartis’ attempt to patent Gleevec’s crystalline form in 2013. Brazil requires health ministry approval for pharmaceutical patents, adding another layer of review. In contrast, the U.S. and Europe allow broad secondary patenting under current laws, though regulators are tightening rules.

What’s the biggest controversy around secondary patents?

The "evergreening" debate. Critics argue companies use minor tweaks - like changing a pill’s color or release method - to extend monopolies without real patient benefits. For example, AstraZeneca’s switch from Prilosec to Nexium (a single enantiomer) added 8 years of exclusivity but offered only modest improvements. Meanwhile, drug prices stay high, with Humira costing $20 billion annually before generics arrived.

How do generic drug companies challenge secondary patents?

They file "Paragraph IV certifications" with the FDA, claiming the secondary patent is invalid or not infringed. In 2022, 92% of listed secondary patents faced these challenges. However, only 38% succeed in court. For example, generic makers challenged Humira’s patents for years, but AbbVie’s legal team won most cases until 2023. Costs for these challenges average $15-20 million per product.